How Artificial Intelligence and Machine Learning will change your business

How Artificial Intelligence and Machine Learning will change your business

There’s no doubt that AI will be the most important tech of the 21st century. The only thing experts don’t fully agree on, is the extent of change to the face of each separate industry and to society as a whole.

A whole slew of highly specialized AI is about to enter the market and turn it upside down.

Mercedes, Tesla, and Ford race to deliver the first self-driving cars that will shake up the world of freight transportation and everyday commuters. Pharmaceutical companies are pouring billions into AI capable of challenging oncologists in cancer detection and its treatment.

How machine learning can help my business is the question that is on every entrepreneur’s mind. And as always happens with disruptive technologies, the first executives to integrate AI into their companies will reap tremendous rewards while latecomers will risk going out of business.

But while autonomous cars get all the headlines, it’s actually Finances, Retail, and Media that may feel the greatest impact of the new tech. So, how can machine learning improve businesses in these industries?

Retail

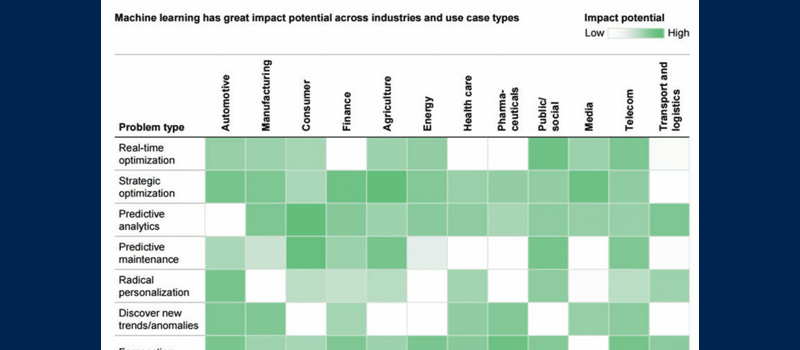

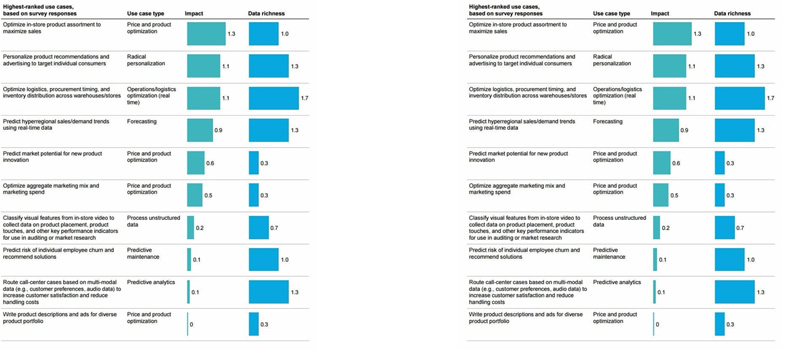

The table shows how Machine Learning could affect retailers. The Impact coefficient (0-2) shows the extent to which AI could change a certain aspect of the industry, while the Data Richness coefficient shows the availability of data required to train AI

The future of AI in retail is all about making your customers personalized offers, predicting future trends in order to optimize your stock and improve logistics. But there is a bigger problem AI can deal with.

1. Fraud prevention

With the e-commerce boom, the number of scams online has shot through the roof. The major stores dedicate great efforts in order to combat fraud on their platforms. But sometimes such attempts cause more harm than good.

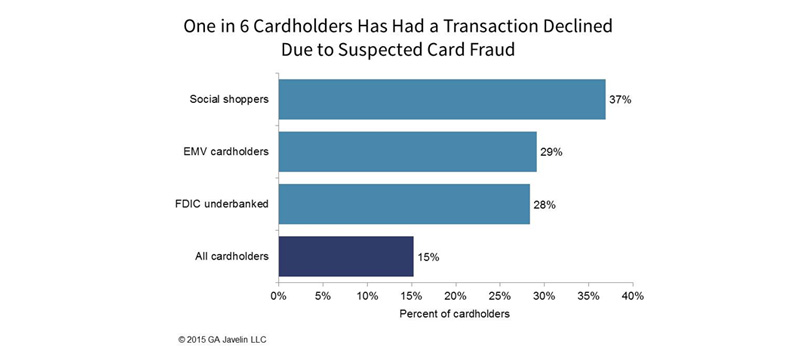

Often banks or vendors decline a completely honest transaction when they suspect it was made by scammers. As Javelin Strategy found out, each year this happens to at least 15% of customers. And there is nothing that destroys customer loyalty faster than being accused of scamming.

A third of wrongly accused customers never come back to complete the transaction resulting in $118 billion lost in potential sales (13 times more than the amount lost to scammers).

Powerful statistical analysis algorithms and access to Big Data allows it to fight cyber crime in real-time and on multiple fronts. To the watchful eye of AI, frauds look like anomalies in a stream of regular transactions. The challenge is sorting out the behavior that looks anomalous but is in fact perfectly legal.

Last year MasterCard has revealed its new service called Decision Intelligence which promises to do that.

It analyzes the behavior of each MasterCard user in order to create a personalized shopping profile. The system then compares each your transaction to this baseline which includes risk evaluation, customer value segmentation, geo-position, vendor and device info, shopping hours and categories of goods bought, etc.

What gives MasterCard its edge over the competitors is the sheer volume of transactions to collect data from (almost 14,5 bln quarterly). One of the main benefits of AI-driven systems is the ability to automate your responses to the anomalies, i.e. punish scammers in real-time and redirect the dubious cases for manual audit. ML tools offer powerful analytics and interactive dashboards to give vendors a better understanding of frauds and devise strategies to combat them.

2. Customer service chatbots

91% of dissatisfied buyers will never return to your store. Quality customer support can make them change their minds. While the smallest vendors struggle to find time to please the unhappy customers, the major players look to ways of cutting labor costs. The answer to both of these problems is the chatbot tech.

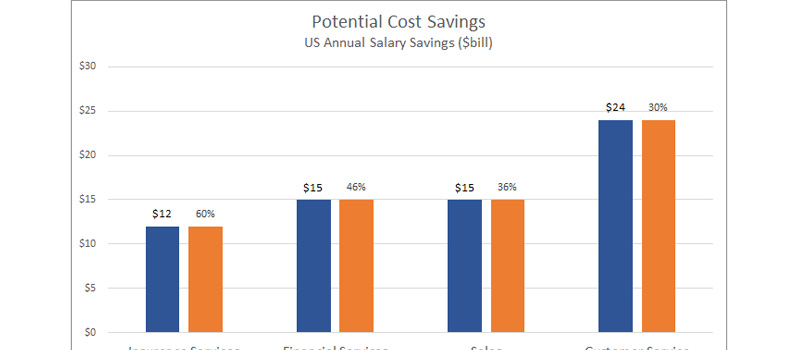

BI Intelligence has estimated that by using AI in customer support, American companies could save up to $23 billion. Today, vendors could automate at least 30% of work done by customer support managers.

In addition to saving money on payroll costs, chatbots provide other benefits:

• 24/7 availability. The role of international trade is constantly growing, so you have to take into account time zone differences and be ready to talk to your customers even if it’s 2AM and you’d rather take a nap.

• Instant response times. Instead of listening to the maddening melody for 10 minutes while waiting for the customer support manager to answer the phone, people can receive an automated message in the vein of “Thank you for your feedback, we’ll contact you in x minutes”.

• The reach of messenger apps. Since 2015, messengers like WhatsApp have become more popular than social media. 64% of customers think it’s vital for a business to be available via a messenger. Since the major messengers opened themselves to chatbots, it’s a good idea to integrate your chatbot with relevant messengers.

3. Personalization and trend prediction

You’ve seen it many times. You visit an e-commerce website, search for some crocs, and maybe buy a couple. You later come back to the same site and all you see are those things.

AI is making recommendations increasingly smart and personalized.

But there are other ways you could benefit from Machine Learning. Otto, a German e-commerce website, is one of the pioneers in AI-assisted retail.

The company discovered that shipping goods in less than two days produced fewer returns. At the same time, the shop’s patrons like to get all the ordered goods in a single package. On Otto’s website, you can buy goods of various brands but the company itself doesn’t warehouse third-party items.

Otto faced a dilemma: wait until all the merchandise arrives and risk increased refunds or anger their customers by delivering their orders piecemeal. They have adopted a Deep Learning AI that was originally developed to deepen our understanding of physics at the Large Hadron Collider.

The algorithm analyses over 3 billion prior purchases and 200 parameters to forecast what shoppers will order in the future. The system has a 90% success rate in predicting what Otto’s customers will purchase during the next month. This enables them order more than 200,000 third-party items in advance.

The AI has reduced the shop’s overstock by 20%. It has reduced the shipping times, as well as decreased Otto’s yearly refunds by more than 2,000,000 items. At the same time, the company didn’t fire a single employee because of its AI system. It even hired some more to account for the retailer’s growth.

Otto’s experience shows that Machine Learning can be used to augment the weak spots of your staff and boost productivity without going on massive firing sprees. Takeaway: Machine Learning will transform e-commerce and save a lot of money for the business owners.

So invest in anti-fraud AI to protect your customers from the usual scammers and the false accusations. Utilize Machine Learning to optimize your stock and offer your clients personalized shopping suggestions. And finally, think about using chatbots in your customer service

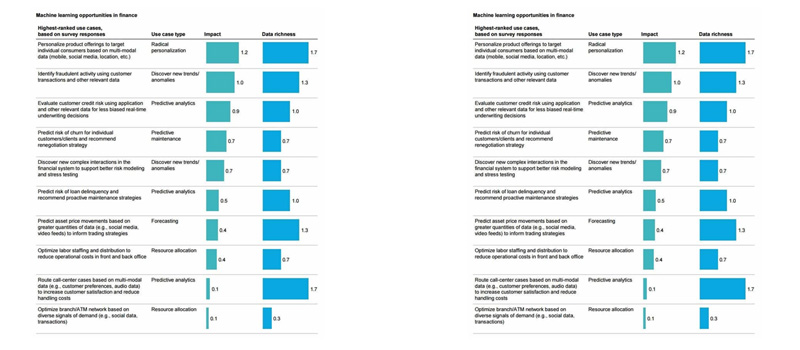

Finances

Financial institutions could use Machine Learning to fight both the frauds and the ‘false positives’. But they also could benefit from providing their clients with personalized robo-assistants and customer support chatbots. All while the hedge funds could use more AI in trading operations.

1. Finance advisors and chatbots

One of the most promising areas for the chatbot tech is personal financial assistants. While Australian startup Acorn hasn’t yet developed its own chatbot, it has harnessed the power of AI to help Millennials save money. The app rounds up every purchase and sends the change to a personal savings account.

But its defining feature is the use of AI to make smart investments and give personalized financial advice. “We’ve got machine learning that goes through and predicts your future spending habits and future income based on your past,” says Acorns Australia director, George Lucas, blurring the line between science fiction and reality.

“It can start giving tips to customers about ways they can adjust their spending and make them aware of how they are spending money.” As a result, ¾ of the app’s users have slashed their expenses. A FB Messenger bot Plum promises to give you an extra bit of cash by making smart savings. After you link it to your bank account, the bot uses ML algorithms to learn everything about your financial situation and spending patterns. On a weekly basis, it sets aside a portion of your funds into your deposit account.

You can then use Plum’s conversational interface to monitor your finances or even make investments. Large banks also try to keep up with the tech startups. Last year, Bank of America has revealed its robo-adviser Erica. ‘Her’ aim is to improve the traditionally poor experience in such areas as payment handling, monitoring the account balance, and settling debts. The bot will also provide its clients with financial advice and educational materials.

According to the bank’s execs, it’s too early to talk about chatbots replacing human operators. Instead, the tech should aid the bank’s employees and make personalized financial advice available to the masses.

2. Trading automation

The stock trading market is in for some shakeup with the advent of AI exchange brokers. But can the same Machine Learning that beat humans in the most complex strategy games master the intricate and shrewd world of jobbing? Sentient Technologies is one of the hedge funds that use the power of AI to discover subtle patterns in stock exchanges and predict trends that could bring profit for its investors.

The company uses Big Data to train its AI at a pace that is simply unattainable for humans. According to Bloomberg, the company’s AI can simulate 1800 days of stock operations in a couple of minutes giving it a tremendous experience to draw decisions from. The tech startup calls its AI an evolutionary intelligence. By borrowing concepts from biology, the company creates a large amount of AI agents (or genes) designed to solve a specific task.

It then applies evolutionary pressure to filter the genes that are better suited to the task from the remaining 95% that get eliminated. Repeat the process a million of times and you’ll get highly-specialized genes that are later used in real stock operations as proof of concept and further training. Unfortunately, the company is pretty secretive about its achievements and won’t disclose its internal gene benchmarks.

Its competitor Numerai has used another approach to training their AI. Without devising their own algorithms, they’ve set a hefty bitcoin reward for the data science experts to create the best stock trading algorithms. The data is encrypted in a way that prevents contestants from gaining proprietary secrets. The company’s CEO, Richard Craib, wants to change the nature of stock trading from a cutthroat competition to something that resembles open-source projects that are often more secure, flexible, and powerful than the proprietary software.

In such an environment, everybody benefits from the cooperation. To make this vision a reality, Craib has introduced a new cryptocurrency called Numeraire. The company gave 1,000,000 tokens to all the scientists that improve its algorithms. The value of the currency is tied to the hedge fund’s performance so that all the participants are interested in creating a better platform and sharing their know-hows with peers.

Although the fund does generate profit, the exact figures remain a mystery. The data on pure AI-driven hedge funds is hard to come by. Eurekahedge AI Hedge Fund Index compared the performance of top 12 hedge funds run by the machines to the average companies in the field. The research shows that computers are in fact better investors with yearly profits of 8.44% vs 4.27% for average hedge funds. But the industry as a whole is still skeptical of AI and so are the investors. For the majority of companies, it’s just another tool (although a pretty important one) in their toolkit. Human traders are still in charge of risk management and making the investments.

The routine tasks, on the other hand, are being actively delegated to the machines. Takeaway: If you’re running a hedge fund, consider investing in better Machine Learning algorithms to aid your human traders (and don’t forget to fight the investors’ skepticism). For other financial institutes, use chatbots to improve your self-service. And lastly, consider launching an AI-infused personal financial assistant.

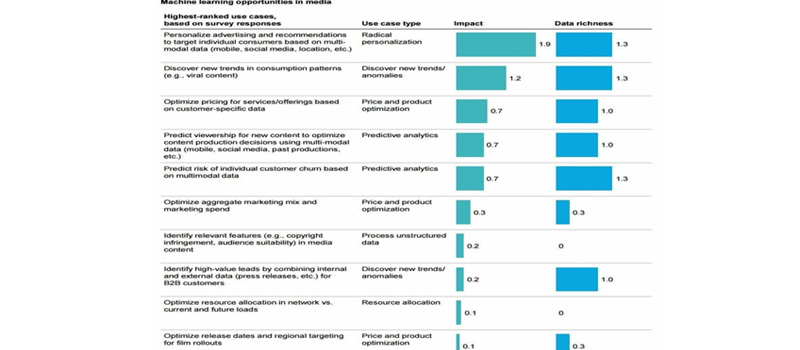

Media

AI will drive the next revolution in mass media comparable to the advent of the Internet. Machine Learning will become the advertisers’ best friend. With the help of AI, they’ll gain a deep insight into the consumers’ hearts and minds and be able to target them with increasingly personalized messages. But there are other uses for AI in the media industry.

In 2016, Washington Post has unveiled its newsbot called Heliograf. The AI debuted during the Rio Olympics. Its developers worked hard to improve the bot for it to take on the role of a political journalist during the US 2016 elections. Here’s how this works: the WP staff builds narrative layouts for the articles with phrases that describe every possible result for the event. Then they feed Heliograf structured data from the elections. The AI finds the relevant data and matches it with the phrases written by the journalists. The system then puts all of this together to create and publish an article. The AI even tailors the message to a platform or an audience.

When Heliograf discovers some anomaly in the data, it messages the editors via Slack allowing reporters to dig deeper and possibly discover a newsworthy story. Heliograf’s chief aim is to build up the paper’s audience. With its analytical capabilities, the AI will take a single article written by a human and create hundreds of its variants each tailored to the preferences of some specific audience. In such a way, the paper hopes to challenge local and niche media. Heliograf will also keep the Washington Post articles updated. When some facts change, the paper’s editors won’t have to go through their past articles and correct them. The AI will do this automatically.

WP points out that the tech isn’t meant to replace journalists. Instead, it takes away some of the labor-intensive tasks (like collecting election data) so that its editors are free to do what they do best: quality political journalism and analytics. The efficiency boost is apparent: during the 2012’s elections it took twenty five hours for four journalists to manually post just a portion of the results. Last year, the AI managed to write over 500 articles with little to no human input. Associated Press has adopted an AI approach to report the earnings of US companies. It now automatically generates over 3,000 quarterly articles, ten times more than it could achieve with human journalists.

According to AP’s execs, automation has freed up almost 20% of the time for its employees. But this hasn’t resulted in a massive layoff. Journalism was always about working with limited resources and choosing to cover one story at the expense of others. Automation has allowed journalists to work on important news and produce more quality content. So the future of AI and media professionals may be more of mutual cooperation. The tech, while offering a lot of benefits, is not without its drawbacks.

It has recently come up that AI sometimes has trouble distinguishing true stories from the fake news. The emotional component of an editorial is also out of AI’s depth. For now, fact-checking and adding the emotional core to the story remains the responsibility of humans. Takeaway: Use Machine Learning to deliver your audience the right content at the right time. Invest in AI to perform the routine tasks and let your employees do the quality journalism.

Prepare your workforce for the future

Even if you have nothing to do with retail, finance, or media, AI will affect your business anyway. All in all, all sustainable progress is driven by people and AI is going to impact your people the most. 2017’s report by the Employment Council of France states that in the coming decade: • 10% of careers in the country will vanish (such as stock-jobber, driver, low-skill industrial worker, etc.); • 50% of all jobs will change dramatically (physician, software developer, high-skill industrial worker…); • 40% more will remain the same (news commentator, psychologist, teacher…).

To see how much of the work your employees do could be automated, write down a list of tasks that constitute a certain job. Then look at each separate task and check them against these five criteria: 1. Technical feasibility. For some tasks, there is no tech sophisticated enough to do the job, or not enough data to train the AI. 2. Need for complex manual operations. Unlike intellectual labor, robotization has hit a glass ceiling where it’s incredibly costly to automate some of the more complex manual tasks (like making coffee). 3. Social acceptability. It may be that people will be incredibly resistant to robots in some roles. For example, over 50% of respondents are ready to allow robots to care about elderly, while the majority of people would prefer them to stay away from their children.

4. The requirement for generalization. Machines are great at highly specialized tasks but often lack lateral thinking. 5. Need for emotional understanding. People are driven by emotions and a lot of tasks require a deep understanding of this facet of human nature. And while machines can simulate empathy, they can’t really feel it. That’s why human doctors are much better at delivering a diagnosis. Now count how many of the tasks could be automated.

If this number is less than 30%, the job can’t be automated, if more than 70%, AI could replace the human employees, if somewhere in between – the job could benefit from the machine-human partnership. Be ready that a number of new professions will emerge as the result of human-AI partnership (such as AI overseer, labeler of data, AI laws expert, etc.) . This means that in the future, society’s main challenge may not be fighting technological unemployment, but adapting to new realities within the labor market

Companies and governments will have to take an active part in re-educating the population to qualify for the transformed and newly created jobs

Businesses could, for example, launch their own courses to share the real industry experience and teach valuable skills. The very nature of education could change in the coming decade. Instead of taking one 4-5 year degree, people will enjoy (or suffer through) a lifelong education. More and more of us will attend online courses and brief internships that will teach the ropes of the new professions. Changing careers may actually become easier due to the decreased role of the hard skills in the workforce. When hiring, you’ll need to focus more on the candidate’s soft skills like leadership, sociability, and creativity.

To some of us, the AI revolution looks scary as hell. But as it happens with any radical change, those who come prepared will reap tremendous rewards. Not only will you benefit from the increased productivity and reduced expenses. By being proactive and taking social responsibility seriously you could open up a new stream of qualified personnel for your business.

Newsletter

Subscribe to Our Newsletter to get Important News, Keep up on our always evolving product features & technology.